How to Build an ESG Portfolio for Sustainable Growth

How to Build an ESG Portfolio for Sustainable Growth

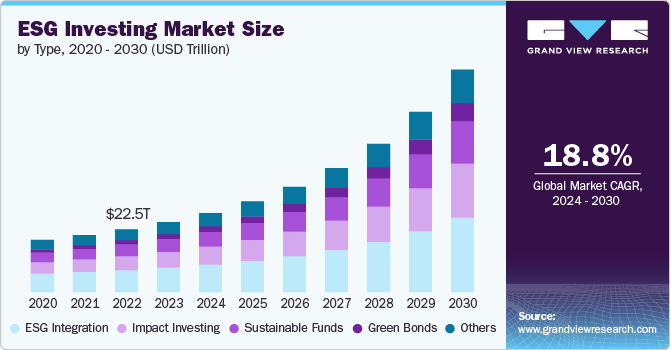

As a middle-aged individual in the United States, you’re likely considering how to ensure your investments align with your values while securing sustainable financial growth. Environmental, Social, and Governance (ESG) investing has become increasingly popular, offering a way to support companies that prioritize sustainability and ethical practices. This article will guide you through the process of building an ESG portfolio tailored to your needs and lifestyle.

Understanding ESG Investing

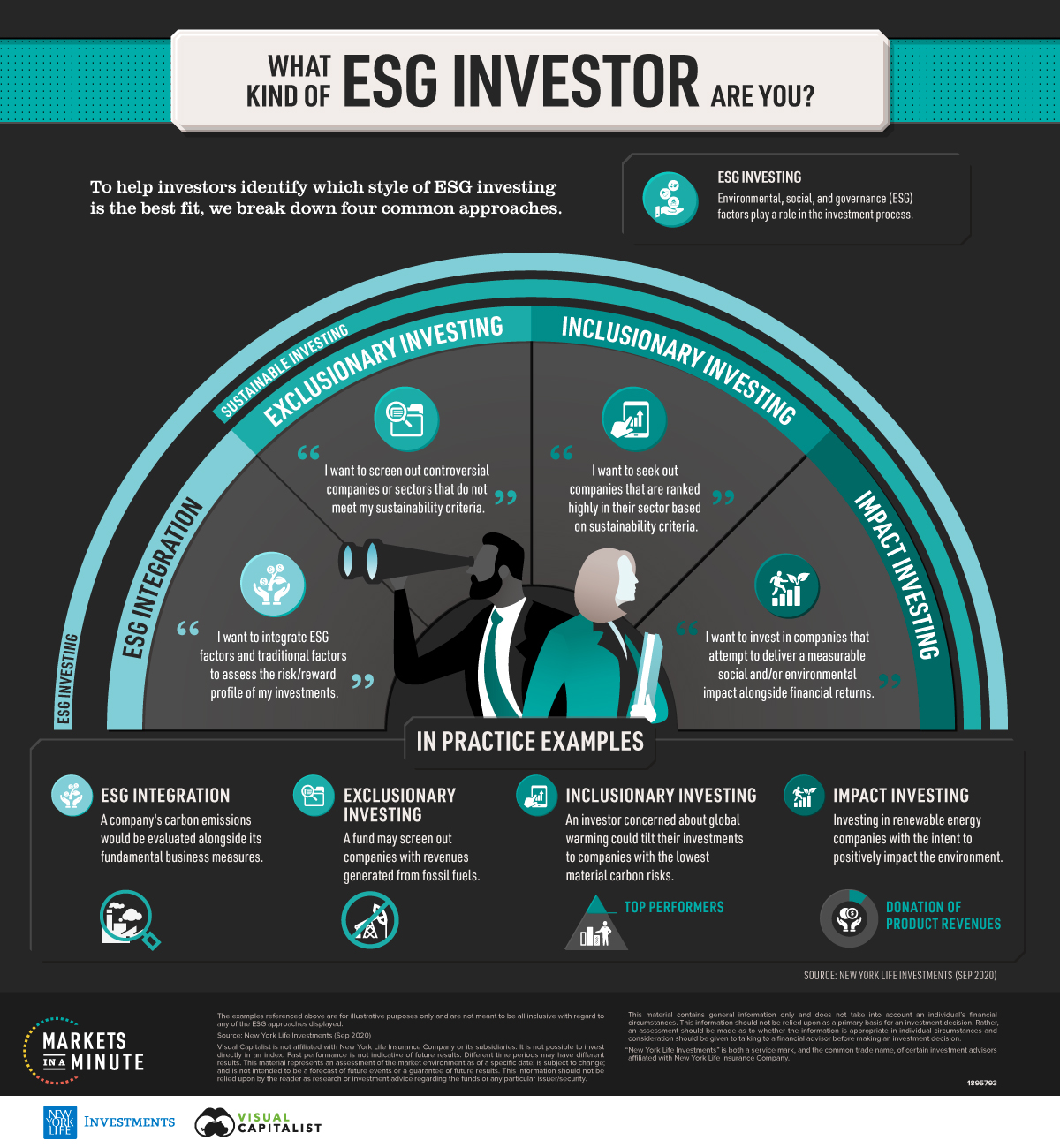

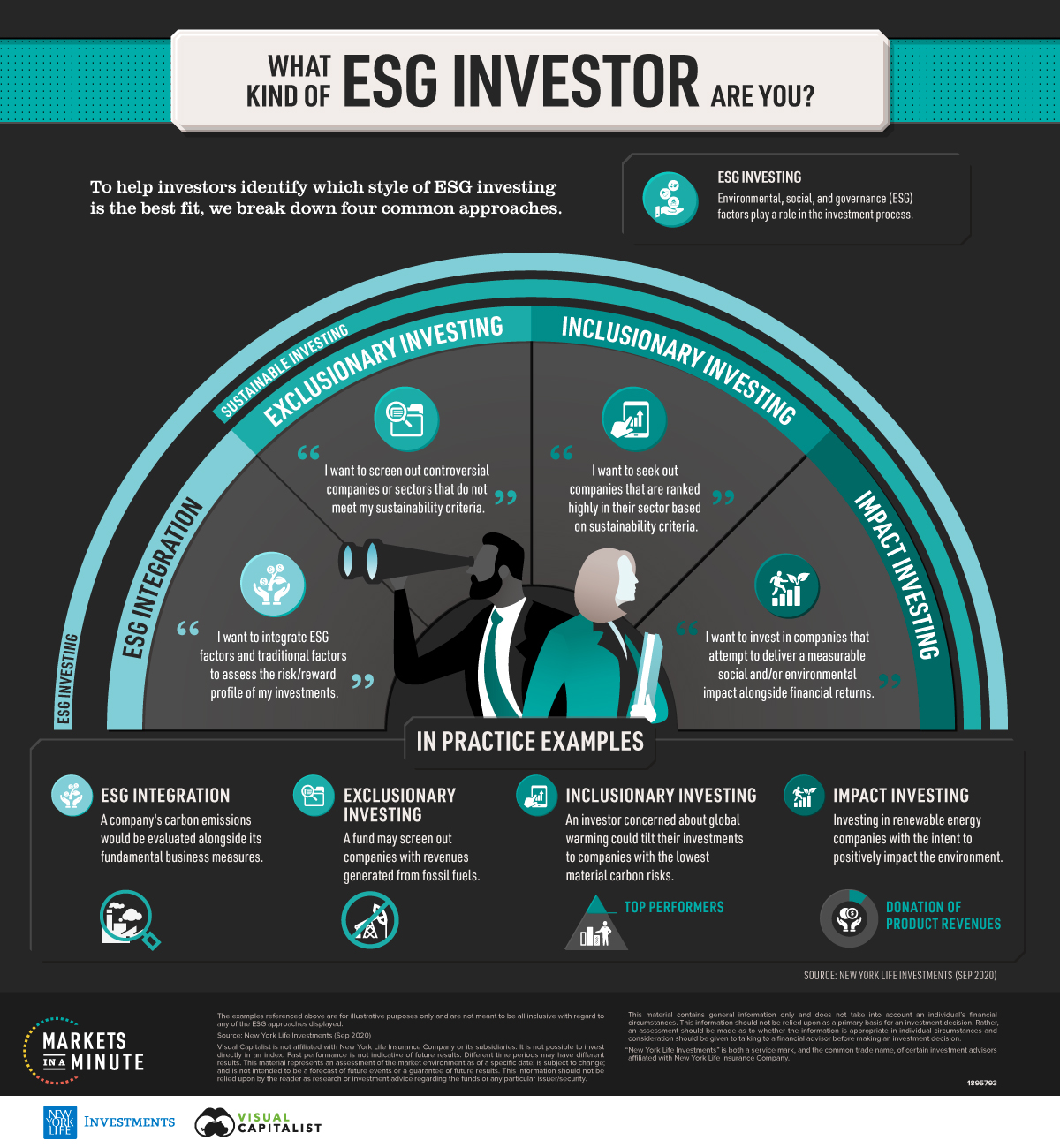

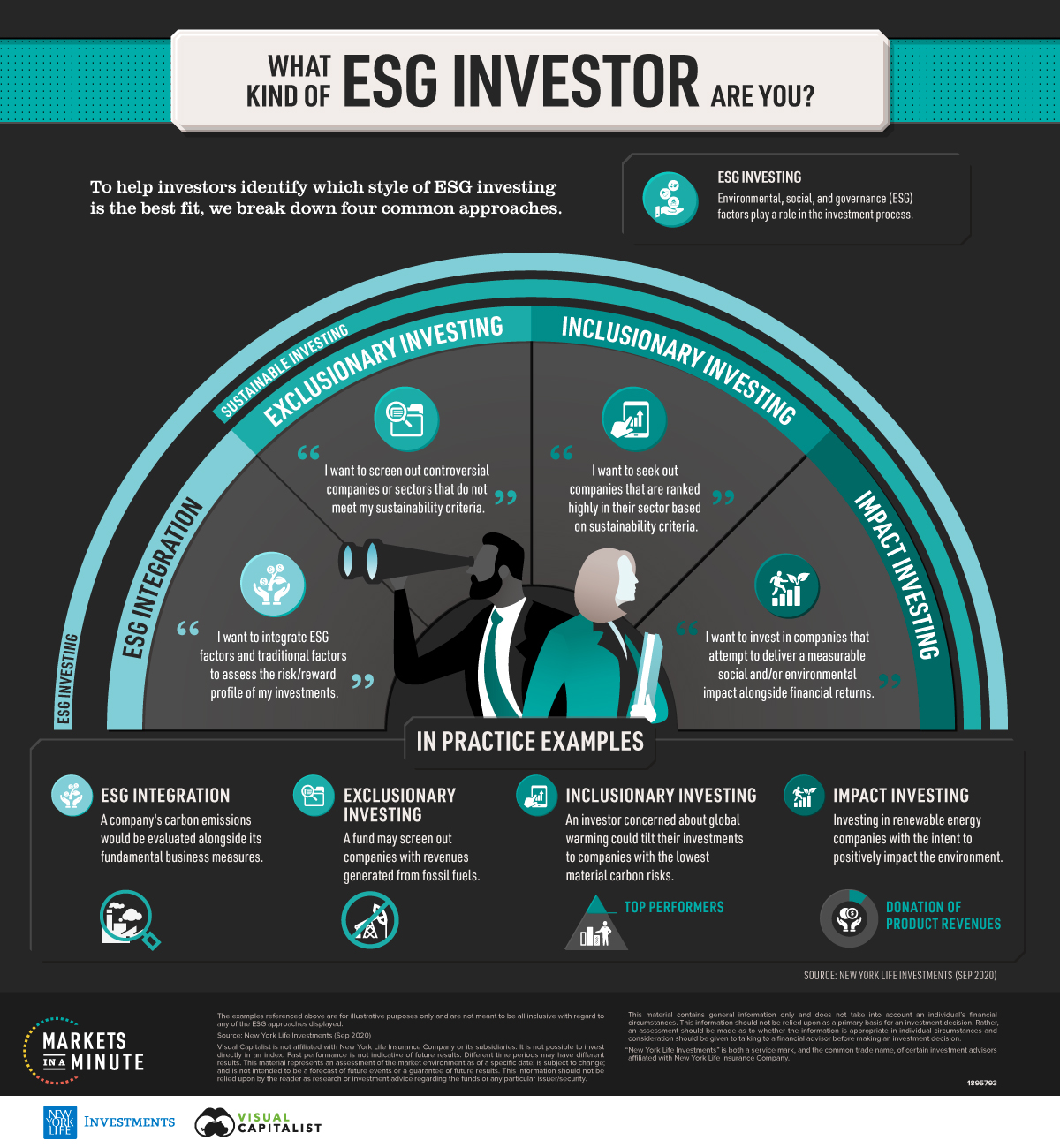

What is ESG Investing?

ESG investing involves evaluating companies based on their environmental, social, and governance practices. This approach helps investors identify companies that are more likely to succeed in the long term by mitigating risks associated with environmental degradation, social unrest, and poor governance .1 .2.

Benefits of ESG Investing

-

Improved Risk Management: ESG investments can help mitigate risks related to environmental regulations, social unrest, and governance issues .10.

-

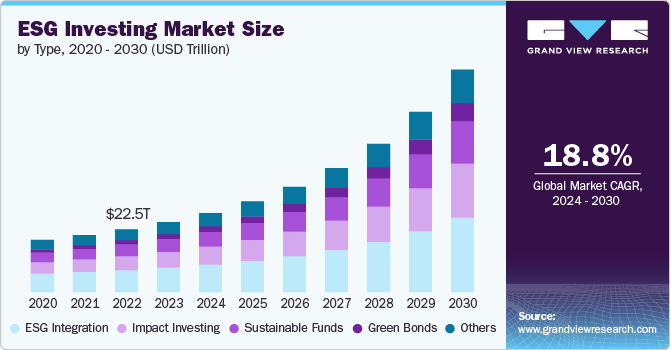

Enhanced Portfolio Performance: Studies show that ESG investments often outperform traditional funds over the long term .10 .15.

-

Alignment with Personal Values: ESG investing allows you to support companies that reflect your values, contributing to a sense of purpose and satisfaction .15.

Strategies for Building an ESG Portfolio

1. Negative Screening

This strategy involves excluding companies that do not meet certain ESG criteria, such as those involved in fossil fuels or tobacco .7. For example, if you’re concerned about climate change, you might exclude companies with high carbon emissions.

2. Positive Screening

Identify companies with strong ESG performance and positive societal impacts. Look for companies that are leaders in sustainability and corporate responsibility .7. For instance, companies like Unilever and LVMH have made significant commitments to sustainability .5.

3. Integration

Incorporate ESG factors into traditional financial analysis to make more informed investment decisions .7. This approach helps assess both financial performance and ESG considerations.

4. Impact Investing

Target investments that generate measurable social or environmental impact alongside financial returns .9. This strategy is ideal for those who want to make a tangible difference with their investments.

5. Thematic Investing

Focus on specific ESG themes, such as renewable energy or gender diversity, to capitalize on emerging trends .9. Thematic funds can help you invest in areas that align with your values and are expected to grow.

6. Shareholder Engagement

Engage with companies to advocate for ESG improvements, influencing corporate behavior through dialogue and proxy voting .7. This active approach can lead to better governance and sustainability practices.

Practical Steps to Build Your ESG Portfolio

-

Set Your Goals: Determine what you want to achieve with your ESG portfolio. Are you looking for long-term growth, income, or alignment with specific values?

-

Assess Your Risk Tolerance: Consider how much risk you’re willing to take. ESG investments can offer a balance between risk and sustainability.

-

Choose Your Investment Vehicles: Decide whether to invest directly in stocks, use mutual funds, ETFs, or work with a financial advisor. ESG-focused funds can simplify the process.

-

Monitor and Adjust: Regularly review your portfolio to ensure it remains aligned with your goals and values. Adjust as needed to maintain a balanced approach.

Case Studies and Examples

-

Generation Investment Management: This firm, co-founded by Al Gore, focuses on identifying companies well-positioned for a low-carbon future. Their investment strategy has been successful, with their Global Equity Fund outperforming its benchmark .6.

-

Unilever: Known for its commitment to sustainability, Unilever aims to achieve net-zero carbon emissions and improve livelihoods within its value chain. This approach has enhanced its financial performance and reputation .5.

-

BNP Paribas: This financial institution aligns its portfolios with carbon neutrality goals, supporting clients in transitioning to a low-carbon economy. It also focuses on social impact through financial inclusion initiatives .5.

Overcoming Challenges

While ESG investing offers many benefits, it also presents challenges:

-

Data Consistency: ESG data can be inconsistent, making it difficult to compare companies. Look for standardized reporting and ratings.

-

Greenwashing: Some companies may exaggerate their ESG credentials. Be cautious and verify claims through reputable sources.

-

Regulatory Changes: Stay informed about evolving regulations that may impact ESG investments.

Conclusion

Building an ESG portfolio is a thoughtful and rewarding process that aligns your investments with your values while supporting sustainable growth. By understanding ESG strategies, setting clear goals, and choosing the right investment vehicles, you can create a portfolio that not only benefits your financial future but also contributes to a more sustainable world.

Additional Resources

For those interested in diving deeper into ESG investing, here are some resources to explore:

-

ESG Reporting Standards: Familiarize yourself with standards like the United Nations Principles for Responsible Investment (PRI) to ensure transparency and accountability.

-

ESG Funds and ETFs: Research funds that align with your goals, such as those focused on renewable energy or social equity.

-

Financial Advisors: Consider consulting with advisors who specialize in ESG investing to get personalized advice.

By embracing ESG investing, you’re not only securing your financial future but also contributing to a more sustainable and equitable society.