How to Invest in Climate-Friendly Funds

How to Invest in Climate-Friendly Funds: A Guide for Middle-Aged Investors

As a middle-aged individual in the United States, you’re likely considering how your investments can align with your values and contribute to a sustainable future. Investing in climate-friendly funds is not only a responsible choice but also a potentially lucrative one. This guide will walk you through the basics of climate-friendly investing, highlight key benefits, and provide practical steps to get started.

Introduction to Climate-Friendly Investing

Climate-friendly investing, often referred to as sustainable or ESG (Environmental, Social, and Governance) investing, involves choosing investments that support environmentally responsible practices, promote social equity, and ensure good governance. This approach has gained popularity as investors recognize the potential for long-term financial returns while contributing to global sustainability efforts.

Benefits of Climate-Friendly Investing

-

Financial Performance: Studies show that ESG investments can outperform traditional funds over the long term. For instance, Morningstar found that 58.8% of sustainable funds outperformed their traditional peers over a decade .1.

-

Environmental Impact: By investing in renewable energy, sustainable agriculture, and pollution reduction initiatives, you can help combat climate change and preserve natural resources .2 .3.

-

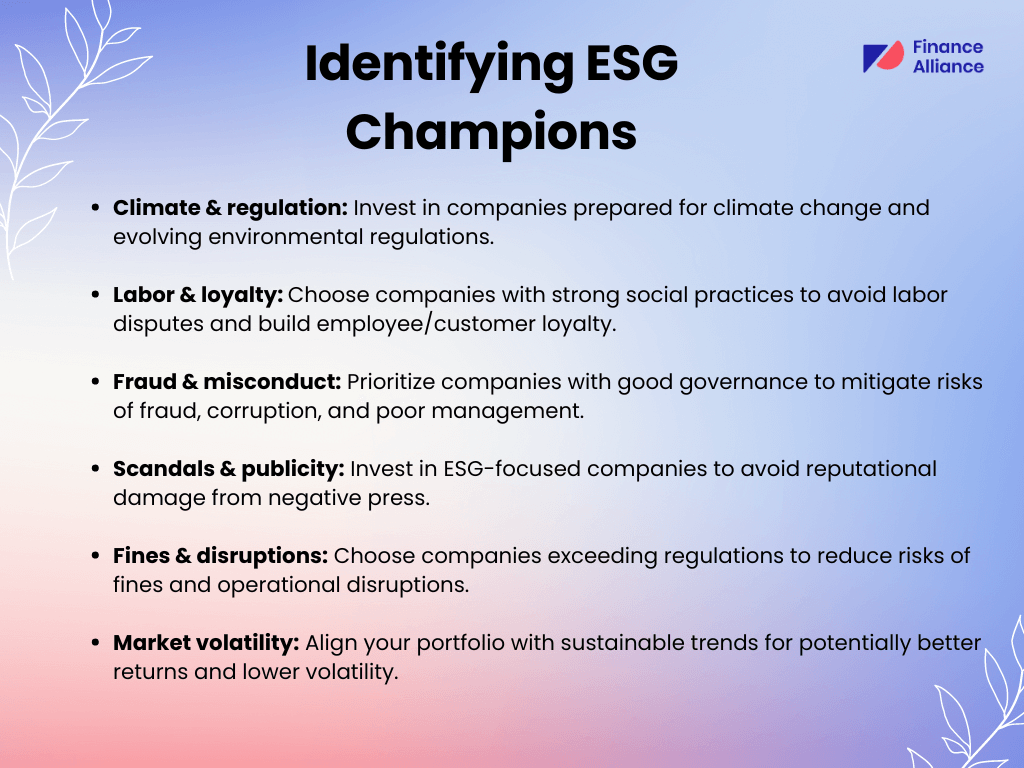

Risk Mitigation: ESG considerations can help investors avoid companies with poor environmental or social practices, reducing the risk of regulatory fines or reputational damage .8.

-

Alignment with Values: Climate-friendly investing allows you to align your investments with your personal values, contributing to a more sustainable future .1 .8.

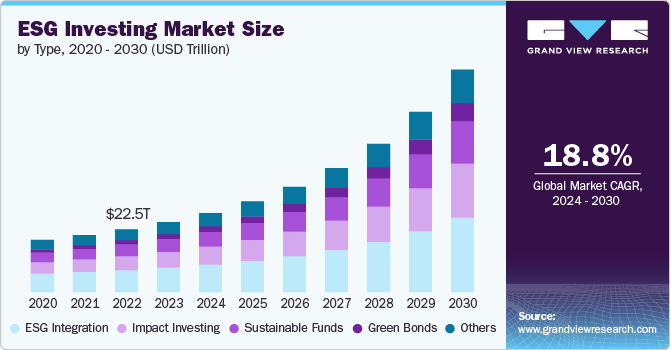

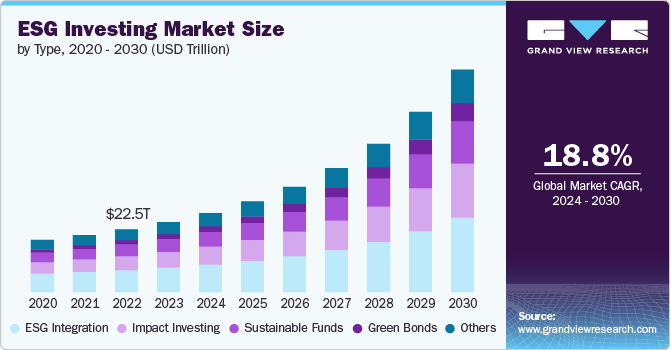

Types of Climate-Friendly Funds

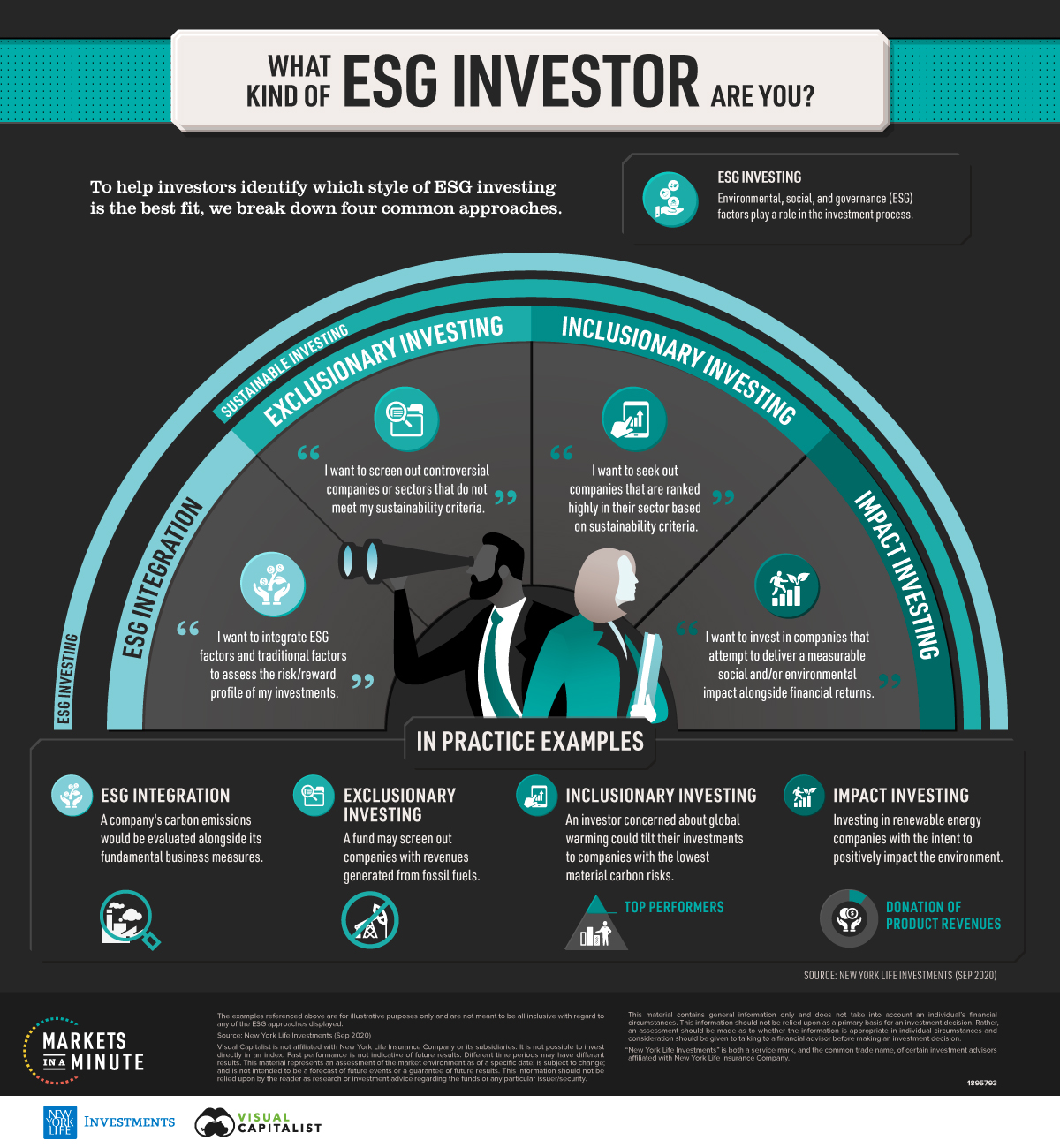

1. ESG Funds

These funds consider environmental, social, and governance factors alongside financial metrics. They often exclude companies with poor ESG performance and favor those with strong sustainability practices .3 .4.

2. Green Funds

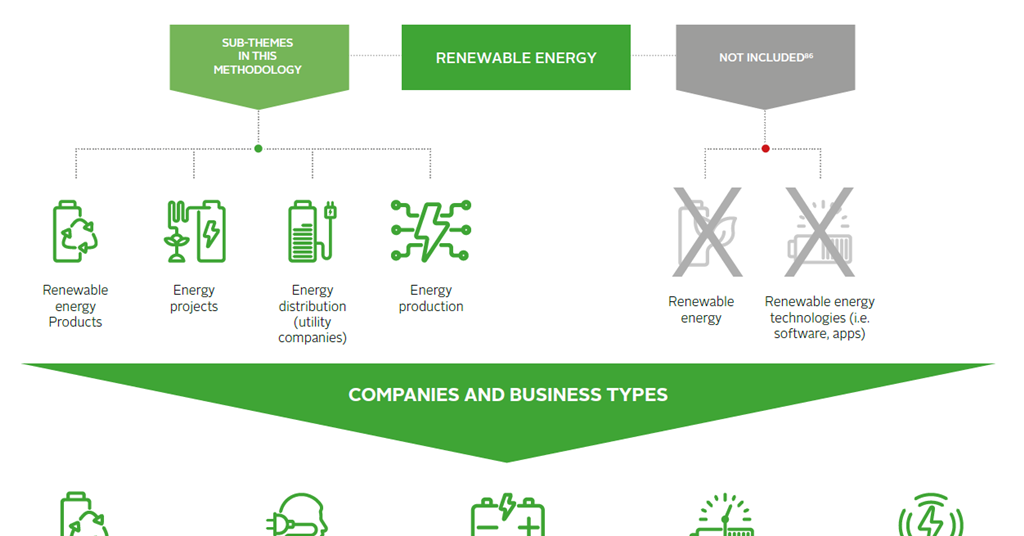

Specifically focused on environmental sustainability, green funds invest in companies involved in renewable energy, sustainable agriculture, and pollution control .4.

3. Impact Investing Funds

These funds target investments that generate measurable environmental or social impact alongside financial returns. Examples include renewable energy projects and sustainable agriculture initiatives .14.

4. Green Bonds

Fixed-income securities used to finance environmentally friendly projects, offering regular interest payments and principal repayment at maturity .14.

5. Sustainable ETFs

Exchange-traded funds that track indices of sustainable companies, offering diversified exposure to climate-friendly investments with intraday liquidity .10.

Practical Steps to Invest in Climate-Friendly Funds

1. Assess Your Financial Goals and Risk Tolerance

Before investing, consider your financial goals, risk tolerance, and time horizon. Climate-friendly investments can offer competitive returns but may involve higher volatility.

2. Research Available Funds

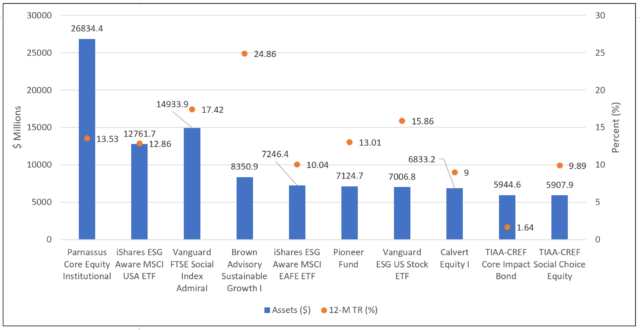

Look for funds with strong ESG ratings and a focus on climate change mitigation. Some top sustainable funds include:

-

Parnassus Core Equity Fund: Integrates ESG factors into its investment decisions .5.

-

Invesco ESG NASDAQ 100 Index ETF (QQCE): Tracks the Nasdaq-100 ESG Index with a focus on U.S. equity .6.

-

iShares Global Clean Energy ETF (ICLN): Invests in renewable energy companies worldwide .10.

3. Consult a Financial Advisor

If you’re new to sustainable investing, consulting a financial advisor can help you navigate the options and create a diversified portfolio.

4. Start Small and Diversify

Begin with a small investment and gradually diversify your portfolio across different types of climate-friendly funds to minimize risk.

5. Monitor and Adjust

Regularly review your investments to ensure they remain aligned with your goals and values. Adjust your portfolio as needed to optimize performance and impact.

Challenges and Considerations

1. Greenwashing

Some companies may exaggerate their environmental credentials. Look for transparent reporting and third-party verification .8.

2. Data Quality

ESG data can vary in quality and availability. Ensure that your investments are based on reliable metrics .8.

3. Short-Term vs. Long-Term Focus

Sustainable investing often requires a long-term perspective. Be prepared to hold onto your investments through market fluctuations .8.

Conclusion

Investing in climate-friendly funds is a powerful way to align your financial goals with your values and contribute to a more sustainable future. By understanding the benefits, types of funds available, and practical steps to get started, you can make informed decisions that support both your financial well-being and the planet. As the demand for sustainable investments continues to grow, now is an excellent time to explore this rewarding and impactful investment strategy.

Additional Resources for Further Reading: