How to Optimize Monthly Spending to Increase Savings

How to Optimize Monthly Spending to Increase Savings

In today’s economic climate, optimizing your monthly spending to boost savings has become more crucial than ever, especially for those in their 40s and 50s approaching retirement. With rising prices across essential categories like healthcare, housing, and education, creating effective saving strategies can help secure your financial future. This comprehensive guide offers practical approaches to trim expenses and maximize savings without sacrificing your quality of life.

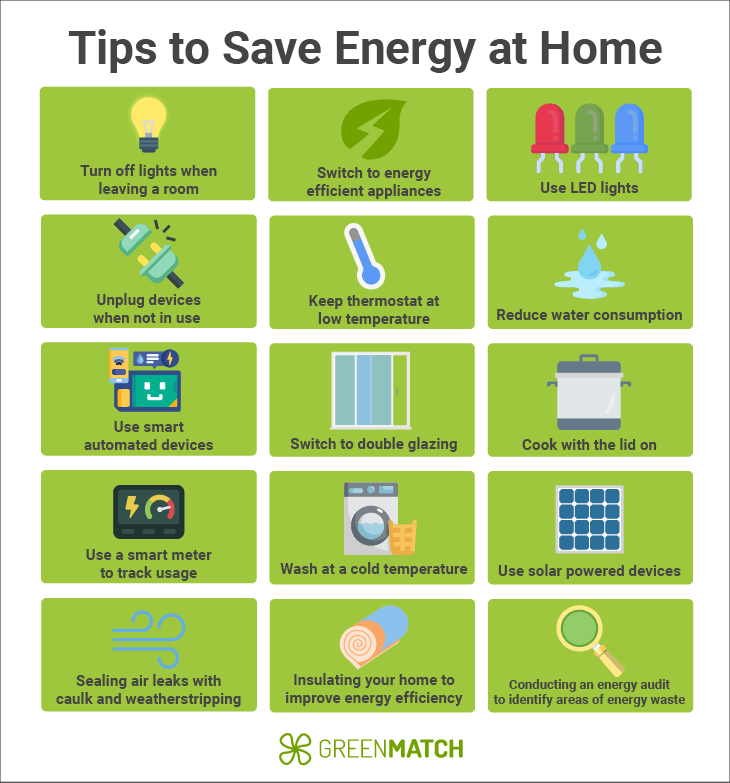

Understanding Your Current Financial Picture

Before making changes to your spending habits, you need a clear picture of where your money goes each month.

Track Your Expenses

Begin by documenting all your expenses—from your morning coffee to monthly bills .1. You can use:

-

A simple spreadsheet

-

Free online spending trackers

-

Budgeting apps

-

Traditional pencil and paper methods

After collecting this data, organize expenses by categories such as utilities, groceries, transportation, and entertainment. This breakdown will reveal patterns and potential areas for reduction .1.

![]()

Implement a Budget Framework

Consider using the 50/30/20 rule as a starting point:

-

50% for essential expenses (housing, food, utilities)

-

30% for discretionary spending (entertainment, dining out)

-

20% for savings and retirement goals .2

This framework provides a balanced approach that acknowledges both needs and wants while prioritizing future financial security.

Strategies to Reduce Fixed Monthly Expenses

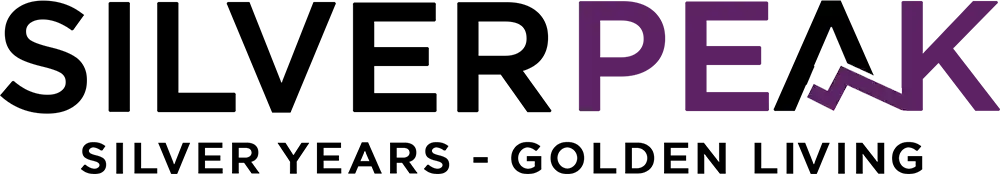

Housing Costs

Housing typically represents the largest portion of monthly expenses. Consider these options:

-

Downsizing to a smaller home

-

Refinancing your mortgage if rates are favorable

-

Renting out a spare room for additional income

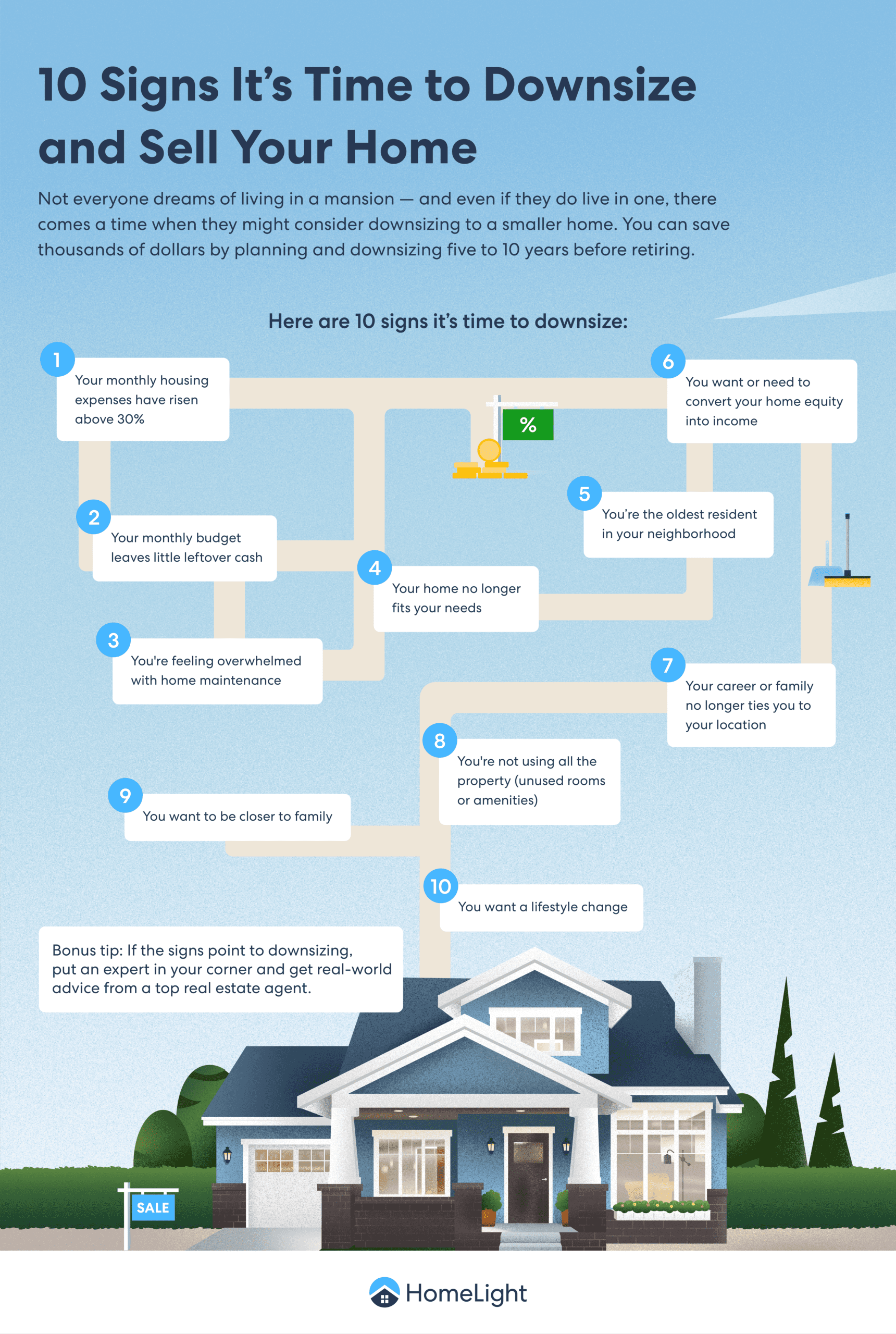

Utilities Optimization

Small adjustments to utility usage can yield significant savings:

-

Lower your thermostat by a few degrees at night or when away

-

Reduce water heater temperature

-

Use smart power strips to eliminate phantom energy usage from devices not in use .9

-

Request an energy audit from your utility provider for personalized recommendations .9

Communication Services

Mobile phone and internet services often have hidden savings opportunities:

-

Bundle cable and internet services with the same provider

-

Sign up for automatic and paperless payments to receive discounts

-

Review your cell phone plan to ensure it matches your actual usage

-

Consider switching to a prepaid plan or MVNO (Mobile Virtual Network Operator) like Cricket Wireless, Mint Mobile, or Boost Mobile .3

-

For those 55+, explore senior-specific plans like AT&T’s Florida resident plan offering unlimited talk, text, and data for $40 per line .3

Trimming Daily and Discretionary Expenses

Food and Grocery Strategies

Food costs can be significantly reduced with planning:

-

Create grocery lists before shopping to avoid impulse purchases

-

Choose store brands over name brands

-

Join store loyalty programs for exclusive discounts

-

Limit dining out to once per week instead of multiple times .6

-

Take advantage of restaurant specials and happy hours when eating out .9

-

Plan to cook most meals at home .1

Subscription Audit

Recurring subscriptions can silently drain your budget:

-

Review all subscriptions and cancel those you rarely use

-

Be especially vigilant about services that renew automatically .1

-

Consider sharing subscription costs with family members

-

Rotate streaming services rather than maintaining multiple subscriptions simultaneously

Smart Shopping Habits

Develop mindful shopping practices:

-

Implement a waiting period for non-essential purchases (wait 48-72 hours before buying) .1

-

Shop secondhand for clothing and household items at thrift stores or consignment shops .9

-

Use browser extensions like Honey or RetailMeNot to find online discount codes .9

-

Explore Facebook or Nextdoor “freecycle” groups for free or low-cost items .9

Leveraging Age-Specific Advantages

Senior Discounts

At 40-55, you’re approaching or may already qualify for various senior discounts:

-

Pharmacy discounts (Walgreens offers 20% off eligible items on Seniors Days) .3

-

Grocery store senior discount days (Fred Meyer offers 10% off, Harris Teeter provides 5% off) .3

-

Entertainment venues often provide age-based discounts

-

Travel discounts through AARP membership

Healthcare Cost Management

Healthcare expenses tend to increase with age:

-

Review your health insurance plan annually to ensure it meets your changing needs

-

Consider a Health Savings Account (HSA) if eligible

-

Take advantage of preventive care services that are often covered at 100%

-

Compare prices for prescription medications across different pharmacies

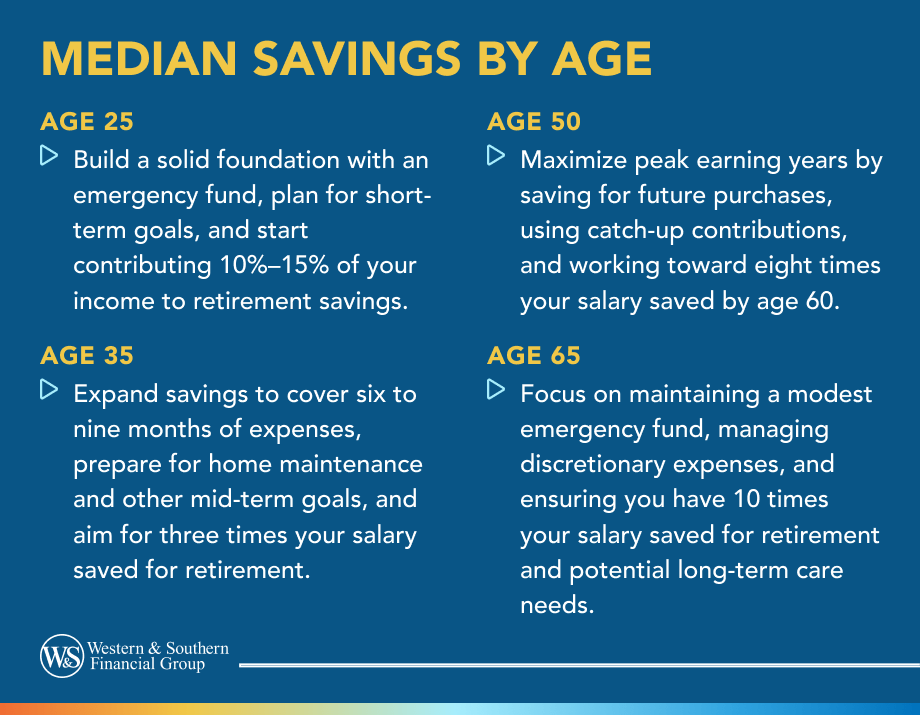

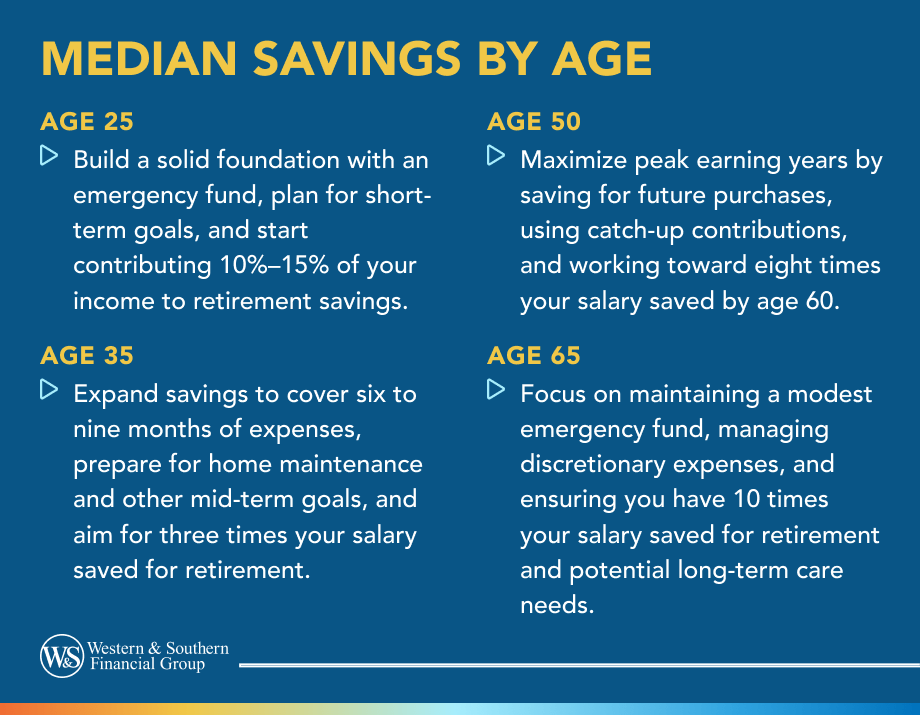

Accelerating Savings in Your 40s and 50s

Maximize Retirement Contributions

This age range represents critical saving years:

-

Max out your 401(k) contributions ($23,000 for 2025)

-

Take advantage of catch-up contributions if you’re 50 or older

-

Consider additional tax-advantaged accounts like IRAs .8

College Savings

If you have children approaching college age:

-

Accelerate college savings contributions

-

Explore scholarship and financial aid options

-

Consider community college transfer pathways to reduce overall costs .8

Debt Reduction

Eliminating high-interest debt improves your saving capacity:

-

Prioritize paying off credit card balances

-

Consider consolidating or refinancing high-interest debt

-

Aim to enter retirement debt-free, including your mortgage if possible

Creating Sustainable Habits

The Power of Small Changes

The difference between financial security and stress often comes down to small daily choices:

-

Saving just $10 per day ($3,650 annually) can compound to hundreds of thousands of dollars over your lifetime .5

-

A case study showed that saving an extra $10 daily resulted in a $463,000 difference in retirement assets by age 65 .