How to Pay Off Your Credit Card Debt Before Retirement

How to Pay Off Your Credit Card Debt Before Retirement

As you approach your golden years, carrying credit card debt can be a significant burden that impacts your financial security and peace of mind. For middle-aged Americans between 40 and 55, now is the crucial time to tackle credit card debt head-on and pave the way for a more comfortable retirement. This guide will provide you with practical strategies and insights to help you eliminate your credit card debt before you hang up your work boots.

Understanding the Scope of the Problem

Before diving into solutions, it’s important to grasp the extent of credit card debt among your peers. According to recent data, Americans between the ages of 45 and 54 are most likely to have credit card debt, with 57% carrying balances .12. The 55 to 64 age group has the highest average credit card debt at $7,720 .12. These statistics highlight the urgency of addressing this issue before retirement.

The Impact of Carrying Credit Card Debt into Retirement

Entering retirement with credit card debt can have several negative consequences:

-

Reduced retirement savings

-

Limited financial flexibility

-

Increased stress and anxiety

-

Potential need to work longer or part-time during retirement

Strategies to Pay Off Credit Card Debt

1. Assess Your Debt Situation

Start by taking a comprehensive look at your credit card debts. List out all your credit cards, their balances, interest rates, and minimum payments. This overview will help you develop a targeted plan of attack.

2. Choose a Debt Payoff Method

Two popular methods for paying off multiple credit cards are the debt snowball and debt avalanche approaches:

Debt Snowball Method:

-

Focus on paying off the card with the smallest balance first

-

Make minimum payments on other cards

-

Once the smallest debt is paid, move to the next smallest

Debt Avalanche Method:

-

Target the card with the highest interest rate first

-

Make minimum payments on other cards

-

Move to the next highest interest rate after paying off the first

Choose the method that aligns best with your personality and financial situation. If you need quick wins to stay motivated, the snowball method might be ideal. If you’re more focused on minimizing interest payments, the avalanche method could be your best bet.

3. Create a Budget and Find Extra Money

To accelerate your debt payoff, you’ll need to free up additional funds:

-

Categorize your monthly spending (groceries, transportation, housing, entertainment)

-

Look for areas to cut back, especially non-essentials

-

Consider using cash for purchases to avoid overspending .11

-

Explore ways to increase your income through part-time work or selling unused items .3

4. Consider Debt Consolidation Options

For those with good credit, consolidating your credit card debt can simplify payments and potentially lower your interest rates:

Balance Transfer Credit Card:

-

Look for cards offering 0% APR introductory periods (typically 12-21 months)

-

Be aware of balance transfer fees (usually 3-5% of the transferred amount)

-

Aim to pay off the balance before the introductory period ends .9

Personal Loan for Debt Consolidation:

-

May offer lower interest rates than credit cards

-

Provides a fixed repayment timeline

-

Simplifies multiple payments into one monthly payment .1

5. Negotiate with Credit Card Companies

Don’t be afraid to reach out to your credit card issuers:

-

Ask for lower interest rates, especially if you have a good payment history

-

Inquire about hardship programs if you’re struggling to make payments

-

See if they offer any balance transfer promotions .6

6. Consider Credit Counseling

If you’re feeling overwhelmed, professional help is available:

-

Seek out reputable, nonprofit credit counseling agencies

-

They can provide expert guidance on managing your finances

-

May offer debt management plans to consolidate payments and negotiate lower interest rates .8

Lifestyle Changes to Support Debt Payoff

1. Adopt a Cash-Only Approach

Using cash for discretionary spending can help you avoid adding to your credit card balances and make you more mindful of your purchases .11.

2. Find Low-Cost Entertainment Options

Look for free or inexpensive activities in your community to reduce entertainment expenses without sacrificing your social life.

3. Cook More Meals at Home

Reducing dining out can significantly cut your monthly expenses. Get creative with meal planning and cooking to make it enjoyable.

4. Review and Reduce Fixed Expenses

Look for ways to lower your regular bills:

-

Shop around for better insurance rates

-

Negotiate with service providers (cable, internet, phone)

-

Consider downsizing your living space if feasible

Staying Motivated Throughout Your Debt Payoff Journey

1. Set Milestones and Celebrate Progress

Break your debt payoff goal into smaller milestones and reward yourself (in budget-friendly ways) when you reach them.

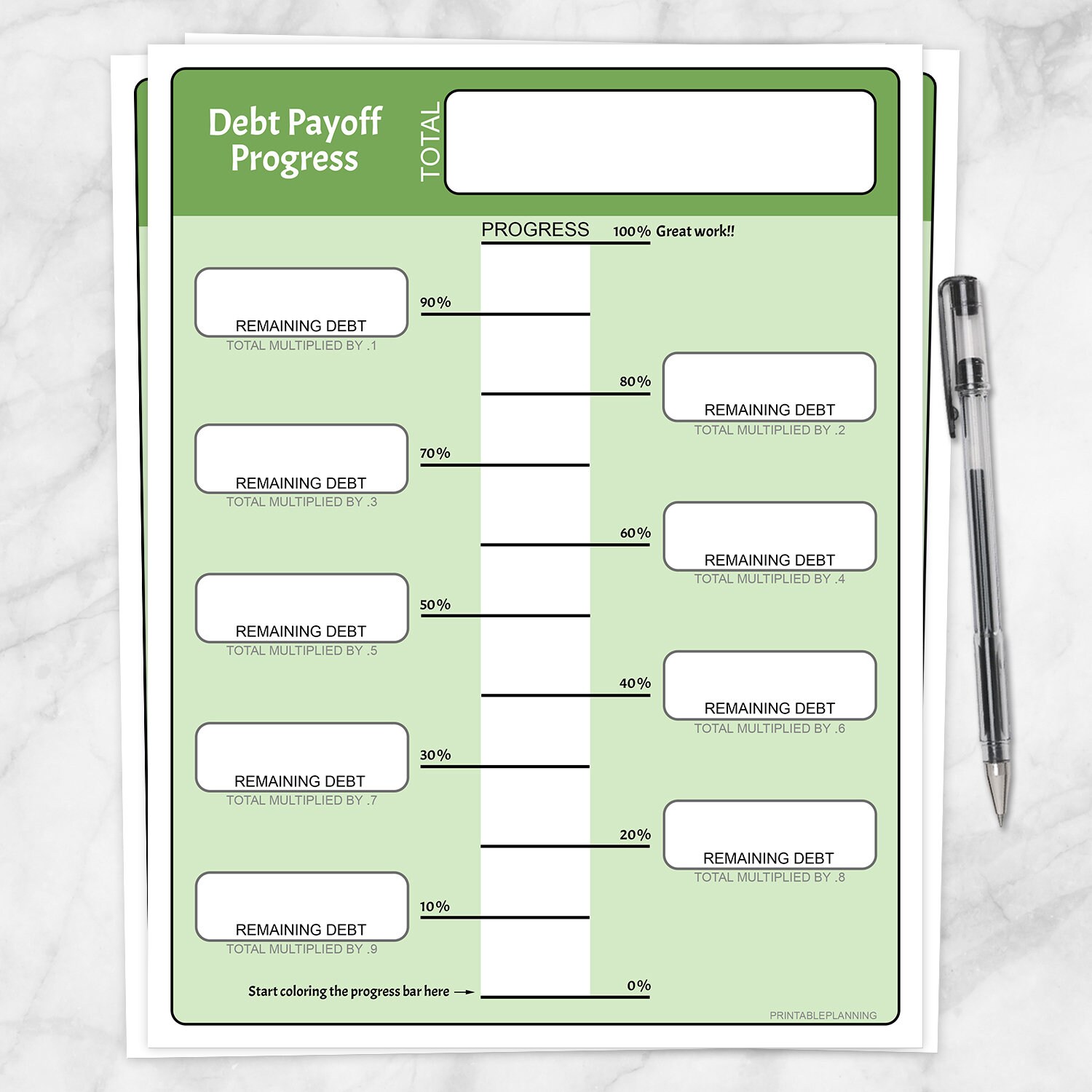

2. Visualize Your Progress

Create a visual representation of your debt payoff journey, such as a debt thermometer or chart, to keep yourself motivated.

3. Find an Accountability Partner

Share your goals with a trusted friend or family member who can offer support and encouragement along the way.

4. Focus on the Long-Term Benefits

Remember that paying off your credit card debt now will set you up for a more secure and enjoyable retirement.

Planning for the Future

As you work on paying off your credit card debt, it’s also important to think about your overall financial health:

1. Build an Emergency Fund

Start setting aside money for unexpected expenses to avoid relying on credit cards in the future .3.

2. Increase Retirement Savings

As you free up money from debt payments, redirect some of it towards your retirement accounts.

3. Develop a Post-Debt Financial Plan

Create a strategy for managing your finances once you’re debt-free to avoid falling back into old habits.

Conclusion

Paying off credit card debt before retirement may seem daunting, but it’s an achievable goal with the right strategies and commitment. By taking control of your debt now, you’re investing in a more secure and enjoyable retirement. Remember, every step you take towards becoming debt-free is a step towards financial freedom and peace of mind in your golden years.

Start today by assessing your debt, choosing a payoff method, and making a plan. Your future self will thank you for the hard work and dedication you put in now. With persistence and the right approach, you can enter retirement with confidence, free from the burden of credit card debt.