How to prepare financially for climate change risks

How to Prepare Financially for Climate Change Risks

As the world grapples with the escalating impacts of climate change, middle-aged individuals in the United States are facing unprecedented financial challenges. Rising temperatures, more frequent natural disasters, and shifting economic landscapes are all contributing factors that necessitate proactive financial planning. This article aims to provide practical strategies for middle-aged individuals to prepare financially for climate change risks, ensuring resilience and stability in the face of these challenges.

Understanding Climate Change Risks

Before diving into financial strategies, it’s essential to understand the types of climate-related risks that can impact household finances:

-

Extreme Weather Events: Hurricanes, wildfires, floods, and heatwaves can cause significant property damage and disrupt employment and access to essential services .1 .2.

-

Economic Disruptions: Climate change can lead to higher costs for consumer goods, increased energy prices, and disruptions in supply chains .1 .3.

-

Healthcare Costs: Climate-related health issues can result in increased medical expenses .1.

Practical Financial Strategies

1. Build an Emergency Fund

Creating an emergency fund is crucial for managing unexpected expenses related to climate events. Aim to save 3 to 6 months’ worth of living expenses in a high-yield savings account. This fund will help cover immediate needs during disasters, such as home repairs or temporary relocation .4 .9.

2. Evaluate and Manage Property Risks

When purchasing or maintaining a property, assess its vulnerability to climate hazards like floods, wildfires, or hurricanes. Consider investing in property insurance that covers these risks. Additionally, explore government incentives for climate-resilient home upgrades, such as tax credits for energy-efficient improvements .9 .15.

:max_bytes(150000):strip_icc()/how-to-handle-water-damage-claims-3860314-FINAL-5ba50164c9e77c0082224c9c-bd6a3a9cc16d425f8fa20c38feb1f100.png)

3. Use Insurance Strategically

Ensure you have robust insurance coverage for your home, health, and life. Review your policies annually to ensure they cover potential climate-related damages. Consider raising deductibles to lower premiums while maintaining coverage for major losses .9 .13.

4. Diversify Investments

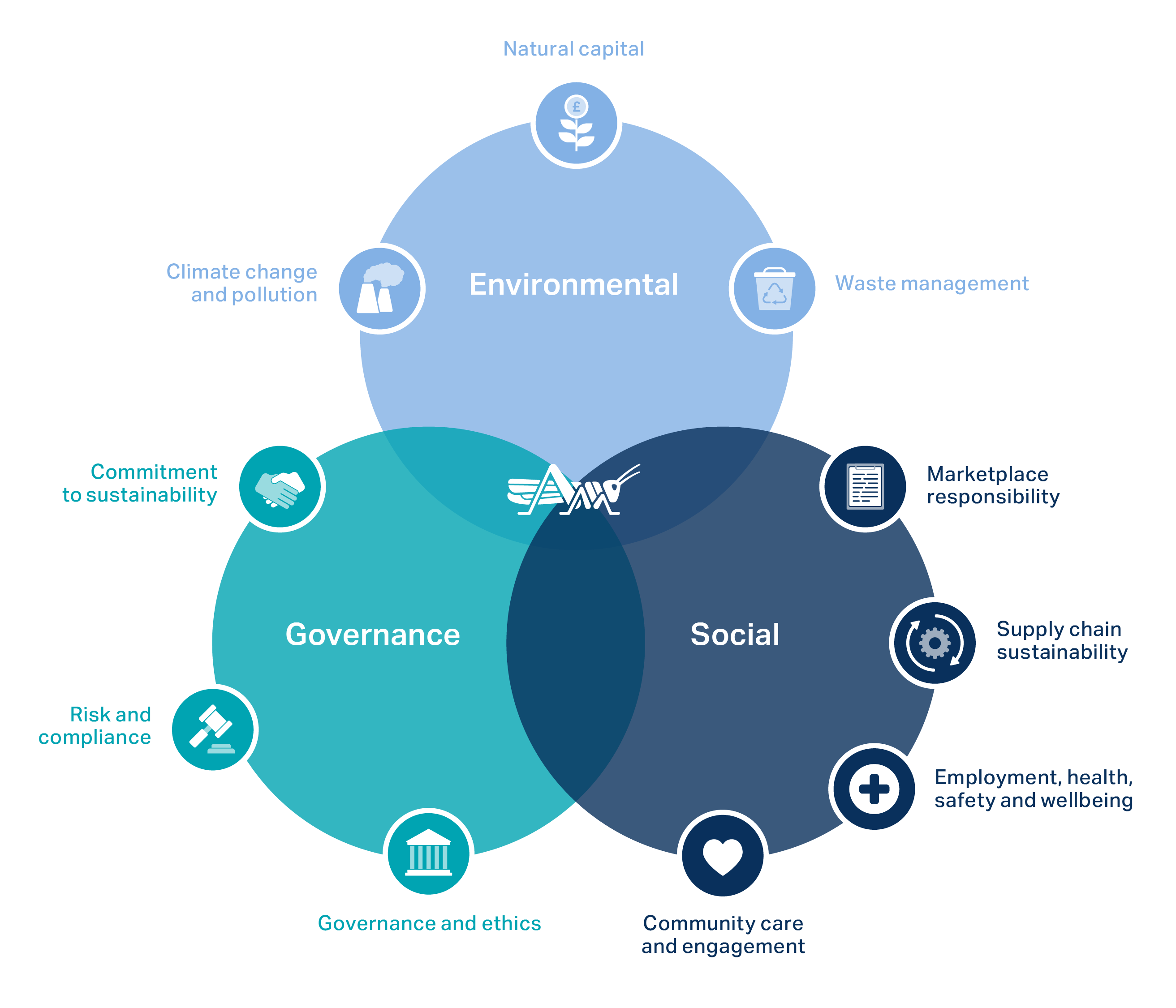

Diversifying your investments can help mitigate financial risks associated with climate change. Consider investing in sustainable technologies or companies that are adapting to climate challenges. This approach not only supports environmental efforts but also potentially offers long-term financial benefits .5 .3.

5. Reduce Your Carbon Footprint

While personal actions may seem small, collectively they can make a significant difference. Reducing energy consumption by using energy-efficient appliances and renewable energy sources can lower utility bills and contribute to a more sustainable future .9.

Financial Planning Tools and Resources

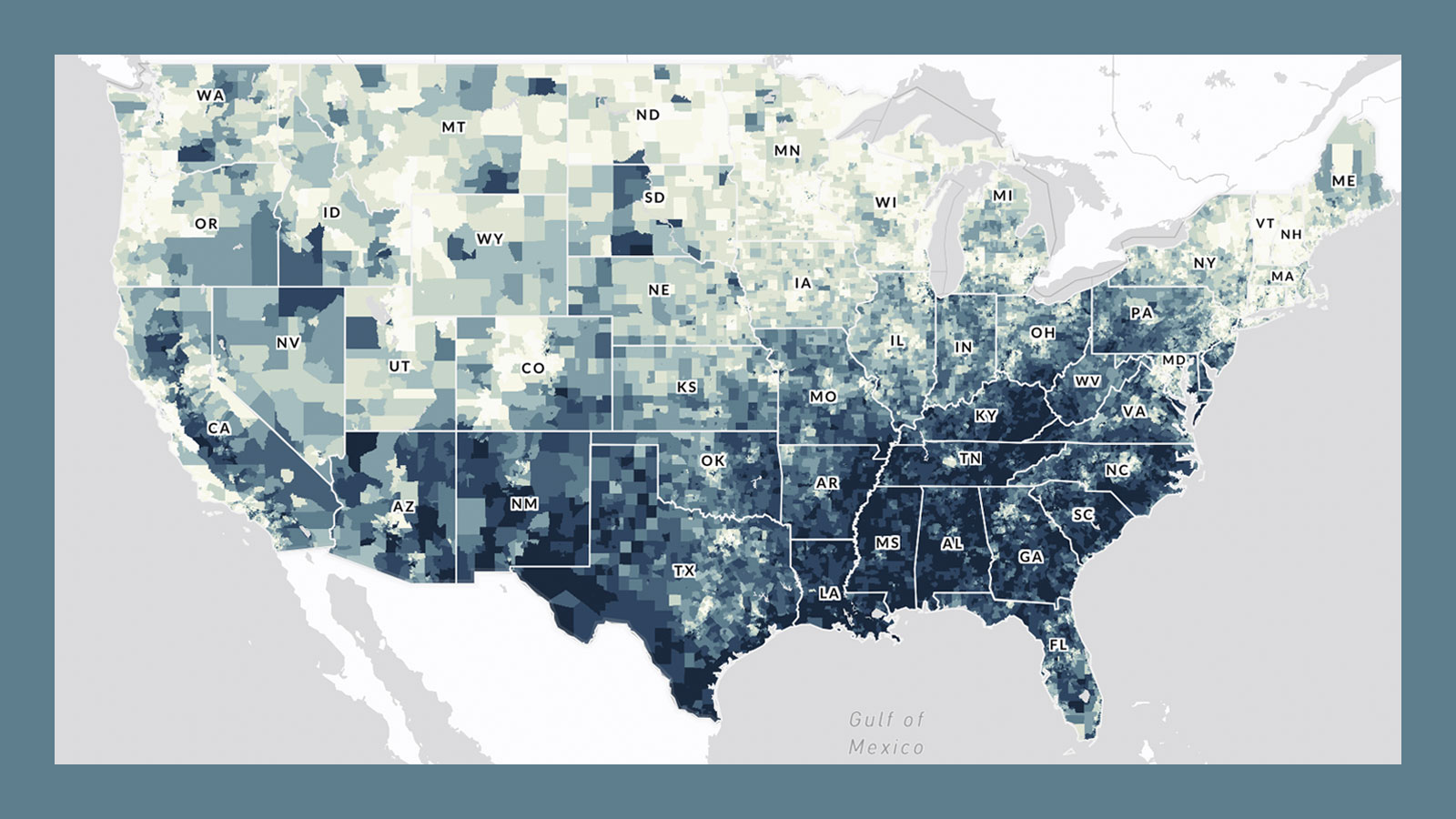

1. Climate Mapping Tools

Utilize resources like the U.S. Climate Resilience Toolkit and Climate Mapping for Resilience and Adaptation to understand specific climate risks in your area. These tools provide valuable insights into potential hazards and strategies for resilience .13 .15.

2. Government Incentives

Take advantage of government programs offering tax credits and rebates for climate-resilient home improvements. These incentives can help offset the costs of upgrading your home to better withstand climate-related events .15.

3. Insurance Industry Resources

Consult with insurance experts to ensure you have adequate coverage for climate-related risks. The Insurance Information Institute offers resources to help consumers understand their insurance options and prepare for disasters .13.

Engaging Your Community

Preparing for climate change is not just a personal endeavor; it also involves community engagement. Here are ways to engage with your community:

1. Educate Yourself and Others

Share knowledge about climate risks and financial strategies with friends and family. Encourage others to prepare by discussing the importance of emergency funds and insurance coverage.

2. Support Local Initiatives

Participate in local initiatives focused on climate resilience. This could include community clean-up events, advocacy for climate policies, or supporting businesses that prioritize sustainability.

3. Advocate for Climate Policies

Engage with local and national policymakers to advocate for policies that support climate resilience and financial stability. This includes supporting legislation that incentivizes sustainable practices and provides relief for climate-related economic hardships.

Conclusion

Preparing financially for climate change requires a proactive and informed approach. By building emergency funds, managing property risks, leveraging insurance, diversifying investments, and engaging with your community, you can enhance your financial resilience in the face of climate-related challenges. Remember, every action counts, and collective efforts can lead to a more sustainable and secure future for all.

Additional Tips for Engaging Content

When writing about financial preparation for climate change, consider the following tips to make your content more engaging:

-

Use Personal Stories: Share real-life examples of individuals who have successfully prepared for climate-related financial challenges.

-

Visuals and Graphics: Incorporate images or infographics that illustrate the impacts of climate change and the benefits of financial planning.

-

Call to Action: Encourage readers to take specific steps, such as building an emergency fund or reviewing their insurance coverage.

-

Interactive Elements: Include quizzes or polls to engage readers and encourage them to share their experiences or opinions on climate change and financial planning.

By incorporating these elements, you can create a compelling and informative article that resonates with your audience and motivates them to take action.